Module 3: Planning Your Career

Choosing a career is one of the most important decisions you will make in your life. You will spend many hours working, so you should choose a career that you enjoy. Your career choice will also affect your ability to meet your wants and needs. It is also important to choose a career that is in demand and that provides you with enough money to live comfortably. In this module, you will learn about self-assessment as a way to begin the process of choosing the career that is right for you. You will also learn how to get your desired job with an effective cover letter, résumé, and interview.

Choosing a career is one of the most important decisions you will make in your life. You will spend many hours working, so you should choose a career that you enjoy. Your career choice will also affect your ability to meet your wants and needs. It is also important to choose a career that is in demand and that provides you with enough money to live comfortably. In this module, you will learn about self-assessment as a way to begin the process of choosing the career that is right for you. You will also learn how to get your desired job with an effective cover letter, résumé, and interview.

After you land that perfect job, you need to understand the W-4 form that you will be required to complete. The W-4 form determines how much tax will be taken out of each paycheck. You need to know how your paycheck will be calculated, so you will also learn about the types of income, taxes, and other deductions that are required by law. You will also learn about benefits that employers may provide in order to increase your compensation. It is important to consider not only the amount you will be paid for your work but also the extra benefits that a potential employer provides.

Pre-Assessment

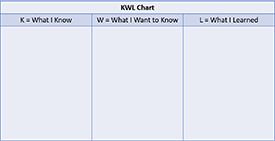

Take a moment to think about one career you want to know more about. Then, create a KWL chart that indicates what you know in the K column, and what you want to know in the W column. Leave the L column blank because you will write what you learned about this career later in the module.

Take a moment to think about one career you want to know more about. Then, create a KWL chart that indicates what you know in the K column, and what you want to know in the W column. Leave the L column blank because you will write what you learned about this career later in the module.

Key Vocabulary

To view the definitions for these key vocabulary terms, visit the course glossary.

| Allowance | Derived Demand | Inheritance | Productivity |

| Apprenticeship | Dividends | Interest | Résumé |

| Aptitude | Earned Income | Internship | Return on Investment |

| Benefits | Exempt | Interview | Salary |

| Bonus | FICA | Job | Self Assessment |

| Career | Garnishment | Market Value | Tips |

| Commission | Gross Pay | Net Pay | Unearned Income |

| Cover Letter | Human Capital | Overtime | Wage |

| Deductions | Incentives | Piece Rate | W-4 Form |