Module 4: Taxes

Even if you don't have a job, taxes are a part of your life. Every time you go to the store or receive a paycheck, you pay some type of tax. Why do we pay taxes? What do our taxes fund?

Although you may not always be aware of it, lots of things that you use are paid for with your tax dollars. Some examples are the roads and highways that get you there fast; the police, firefighters and military who protect you; and the salaries for the people who enforce the laws to make sure you have clean air to breathe and products that are safe to use. No individual, no matter how rich he or she may be, could come close to paying for all these services on their own. Only through our collective tax dollars can we pay for so many services to make our lives better.

The U.S. Federal Government, as well as your state and local governments, collects various types of taxes to pay for services. In this module, you'll learn about the different types of taxes that people pay and what this money funds. You'll also learn how to fill out different income tax forms for when you start working, if you haven't already done so.

Pre-Assessment:

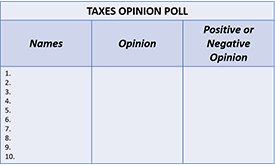

In this module, you will discover why Americans pay taxes, as well as how you personally pay taxes and will continue to do so in the future. Even though paying taxes is inevitable, people have varying opinions on the process and requirements. For this pre-assessment, take a poll of ten adults you know, including family members, friends, and neighbors. Ask each individual his or her opinion on paying taxes. Record all answers in a chart, and then categorize each thought as positive or negative. Hold onto your poll, because you will revisit it at the end of the module.

In this module, you will discover why Americans pay taxes, as well as how you personally pay taxes and will continue to do so in the future. Even though paying taxes is inevitable, people have varying opinions on the process and requirements. For this pre-assessment, take a poll of ten adults you know, including family members, friends, and neighbors. Ask each individual his or her opinion on paying taxes. Record all answers in a chart, and then categorize each thought as positive or negative. Hold onto your poll, because you will revisit it at the end of the module.

Key Vocabulary:

To view the definitions for these key vocabulary terms, visit the course glossary.

| 1040 Tax Form | Exempt | Public Good |

| 1040EZ Tax Form | Federal Income Tax | Regressive Taxes |

| 1099INT Tax Form | Federal Insurance Contribution Act (FICA) or Social Security | Road Tolls |

| 760 Tax Form | Food Tax | Sales Tax |

| Adjusted Gross Income (AGI) | Gift Tax | Taxable Income |

| Allowance | Gross Pay | Tourism Tax |

| Deduction | Progressive Taxes | Wages |

| Dependent | Medicare Tax | W-2 |

| Direct Deposit | Property Tax | W-4 |

| Estate Tax | Proportional Taxes | Withholding |

| Excise Tax |