Module 4: Taxes

![]() Are you tax savvy? In this activity, you will take on the role of someone who will be obtaining a job and paying taxes for the first time. You will be required to complete tax forms and submit answers to questions. Use this checklist to see how you will receive points for this assignment. You will use the information below to complete the assignment:

Are you tax savvy? In this activity, you will take on the role of someone who will be obtaining a job and paying taxes for the first time. You will be required to complete tax forms and submit answers to questions. Use this checklist to see how you will receive points for this assignment. You will use the information below to complete the assignment:

Scenario

You have finally graduated from college. You will obtain your first full-time job as an assistant video game designer.

Profile |

Income |

| Name: John C. Smith | Salary: $40,000.00/year |

| Social Security #: 545-999-8888 | Interest Income from Savings Account: $24.30 |

| Address: 830 Apple Street, Appleton, WI 98969 | You will be using the standard deduction. |

| Marital Status: Single, No Dependents | |

Other Background Information:

|

Step 1: The W-4 Form

![]() Using the W-4 form found on the IRS website, complete the form that employers use to calculate your payroll taxes before you start your job. You will be able to complete this form online and then save it to your desktop. Once you have completed the W-4 form, use the information to answer the following questions.

Using the W-4 form found on the IRS website, complete the form that employers use to calculate your payroll taxes before you start your job. You will be able to complete this form online and then save it to your desktop. Once you have completed the W-4 form, use the information to answer the following questions.

- If you claim two allowances instead of three, what will happen to the amount of federal tax withholding in your paycheck?

- Will the amount withheld increase or decrease when you increase the number of allowances?

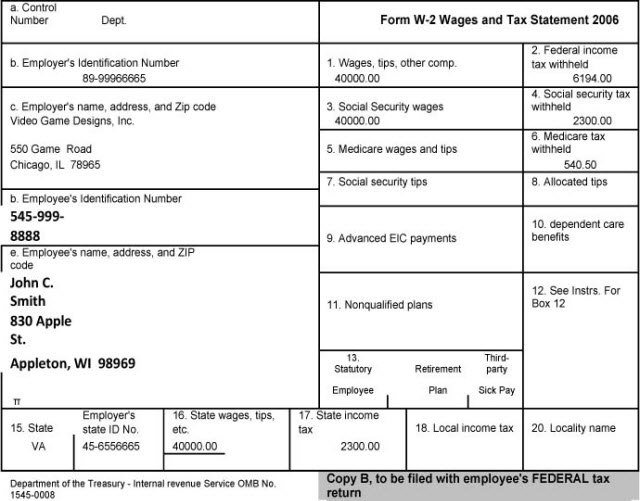

Step 2: The W-2

Here is your W-2:

Step 3: The1040EZ Form

![]() Using the 1040EZ form found on the IRS website, complete the form based on all the information that has been provided above. Then, use the IRS website's tax table to help you answer the questions.

Using the 1040EZ form found on the IRS website, complete the form based on all the information that has been provided above. Then, use the IRS website's tax table to help you answer the questions.

1040EZ Questions:

- Will you owe money to the IRS or get a refund? If so, how much?

- Are you going to file using standard mail or electronically?

- Whether you owe taxes or receive a refund, you will decide if you want that payment electronically drafted or deposited in your banking account. If you decide to have an electronic payment, what banking information will you need to provide the IRS?

- What is your adjusted gross income?

- What is your taxable income?

- What is the amount of federal income tax you owe according to the tax table.

![]()

Once you have completed all of the steps to this assessment, submit your forms and a document with the answered questions to the dropbox.

![]()

Once you have completed this module, please complete the module test.