Managing Your Own Checkbook

In this assignment, you will practice managing a checkbook. Provide your responses to the two parts below on the Managing Your Checkbook Worksheet.

In this assignment, you will practice managing a checkbook. Provide your responses to the two parts below on the Managing Your Checkbook Worksheet.

Part I: Verfying Deposits

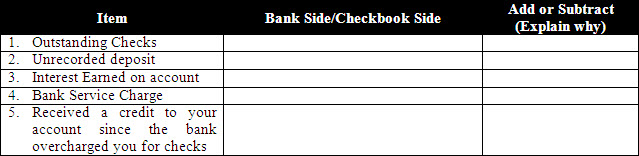

For each of the following items, indicate whether the amount affects the bank side or the checkbook side. Also, explain if the item represents an addition or subtraction from that side.

Part II: I Was Just Buying Groceries When .…

You deposit a $100 check from a friend in your account. A couple of days later, you buy $45.20 worth of groceries and pay with a check.

Two days later you receive a note from the bank stating that your friend’s check bounced and you owe the bank a $25 fee. Since your friend's check bounced, your account balance was actually $100 less than you thought it was, and the check you wrote to the grocery store bounced. Guess what? The bank debited your account another $25 for bouncing the check.

It gets worse. The next day you receive a letter from the grocery store that you owe them $25 in fees for the bad check and that you have to pay the original $45.20 with a money order that will cost you $1. Calculate how much you actually spent for your groceries.

![]()

Once you've completed the Managing Your Checkbook Worksheet, submit it to the dropbox.