Government Finances

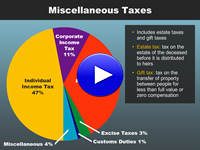

Anyone who has ever received a paycheck is familiar with taxes. Taxes serve as the U.S. government’s primary source of revenue. In this episode, you will examine several different types of taxation, how they are applied, and how much revenue they generate for the federal government. Please click the player button to start the episode.

Download a printable version of this episode.

After the government collects your hard-earned tax dollars, where does all the money go? Most of that money is spent on goods and services that benefit all of society. During this episode of WUSG News, Cain S. Hayek explains what public goods and services are and why the government provides them. Click the player button to begin.

Download a printable version of this episode

Fiscal Policy and Monetary Policy

There are two major instruments used by the U.S. government to influence economic activity: fiscal policy and monetary policy. This episode will discuss these two policies, as well as bonds, inflation, the Federal Reserve, and other important aspects of the American economic system. Click the player button to view this episode.

Download a printable version of this episode

Trade-Offs

Have you ever been faced with a difficult decision where sacrificing something meant gaining something else? In economics, this type of decision is called a trade-off. A trade-off involves giving up one benefit or amount of something in return for gaining another benefit or amount of something. A trade-off is not always monetary and is not an all-or-or nothing decision. The thing not chosen in a trade-off is known as an opportunity cost.

Have you ever been faced with a difficult decision where sacrificing something meant gaining something else? In economics, this type of decision is called a trade-off. A trade-off involves giving up one benefit or amount of something in return for gaining another benefit or amount of something. A trade-off is not always monetary and is not an all-or-or nothing decision. The thing not chosen in a trade-off is known as an opportunity cost.

You have learned that the fiscal and monetary policies of the government are complex and require careful monitoring in order to maintain balance. Maintaining this balance requires trade-offs. For example, sometimes the government has to decrease funding from an existing program, raise taxes, or borrow money in order to fund a new program.

Government Finances Review

![]()

Now that you have learned about taxes, public goods and services, monetary policy, fiscal policy, and trade-offs, it is time to review. Using the information you studied in this topic, please complete this non-graded interactivity. Read the directions for each portion, and answer the questions to the best of your ability. After you submit your answer, you will be able to review it. To begin the review, click the player button.

Now that you have learned about taxes, public goods and services, monetary policy, fiscal policy, and trade-offs, it is time to review. Using the information you studied in this topic, please complete this non-graded interactivity. Read the directions for each portion, and answer the questions to the best of your ability. After you submit your answer, you will be able to review it. To begin the review, click the player button.